Your Oklahoma Hyundai Dealership in Midwest City

Frequently Asked Questions at Joe Cooper Hyundai of Midwest City, Oklahoma

What is Hyundai's finance interest rate?

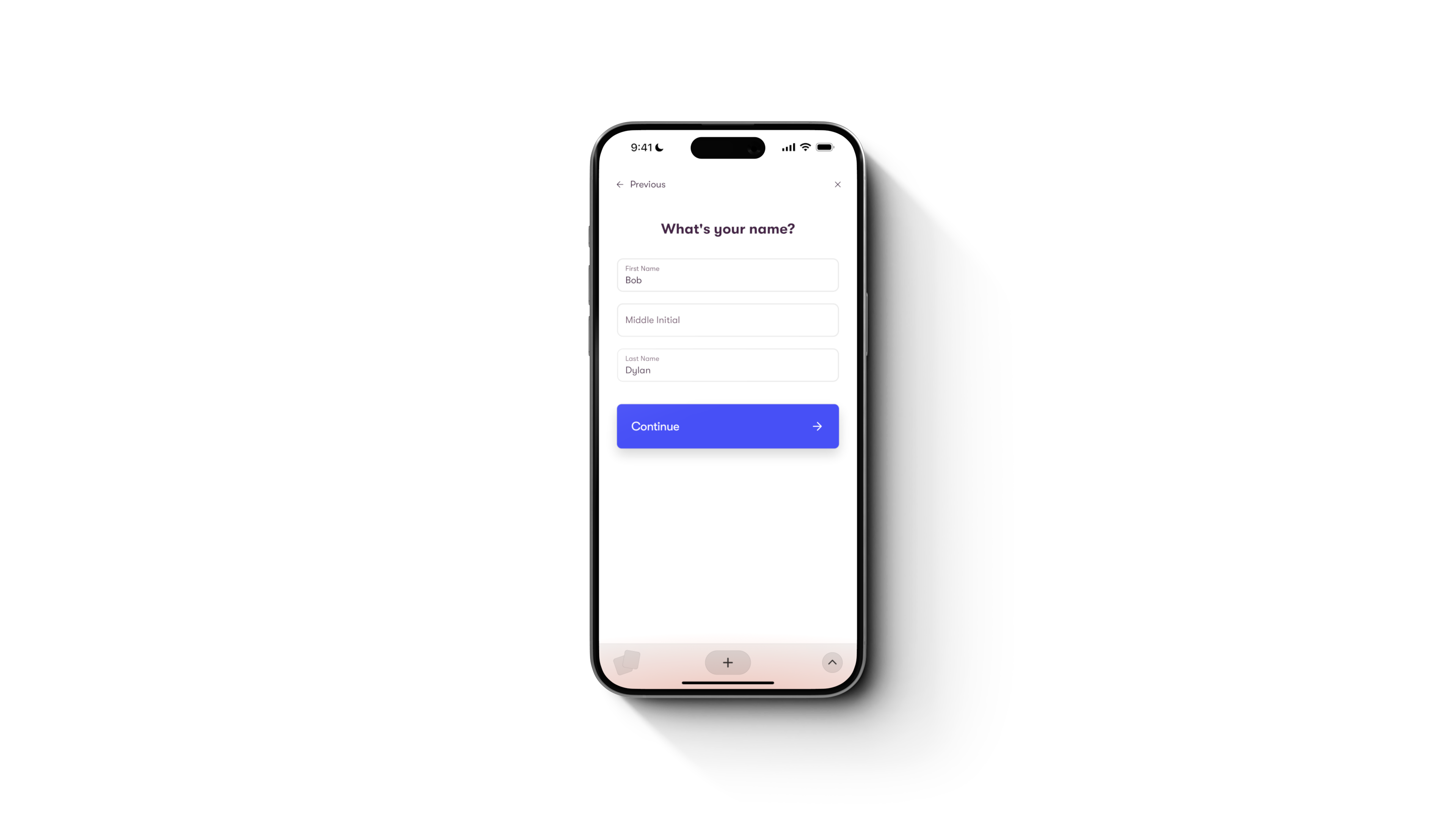

Hyundai finance rates vary depending on the model, loan term, and your credit profile. Special offers like 0% or low APR are often available for well-qualified buyers, but these promotions change frequently. At Joe Cooper Hyundai of Midwest City, our finance team works with multiple lenders to secure competitive rates tailored to your needs. You can apply for financing online or get pre-qualified in just a few taps with no impact on your credit score to see what rates you may qualify for today.

Does Hyundai still have 0% financing?

Hyundai sometimes offers 0% APR on select models, but these specials vary month to month and depend on credit approval. At Joe Cooper Hyundai of Midwest City, you can explore the latest financing options, apply online, or get pre-qualified in minutes with no impact on your credit score. For today’s offers, check our finance center or get pre-qualified before visiting our showroom in Midwest City.

What credit score do you need for 0% APR Hyundai?

0% APR offers on new Hyundai models usually go to buyers with excellent credit, often in the 740+ range, though exact requirements depend on the promotion. At Joe Cooper Hyundai of Midwest City, offers vary month to month, so the best step is to get pre-qualified online in just 90 seconds with no impact on your credit at our pre-qualify tool. From there, our finance team can match you with available incentives, explain your options, and even help with trade-ins at our trade valuation page.

What is APR vs interest rate for Hyundai?

The interest rate is simply what you pay to borrow money, while APR (Annual Percentage Rate) includes that rate plus certain lender fees, giving a clearer picture of your total loan cost. At Joe Cooper Hyundai of Midwest City, our finance team helps explain the difference and find the best fit for your budget. You can explore options now by getting pre-qualified online with no effect on your credit, or start an application at our finance center.

Is Hyundai financing better than a bank loan?

It depends on your situation. Hyundai financing at Joe Cooper Hyundai of Midwest City often comes with special offers and incentives you won’t find at a bank, plus the convenience of handling your purchase and financing in one stop. Banks may sometimes beat rates if you have top-tier credit, but you won’t access Hyundai’s promos. The easiest way to compare is to get pre-qualified online in 90 seconds at our pre-qualify tool or start with our finance center.

What is the best time/month to buy a Hyundai?

End-of-year and holiday events often bring big Hyundai savings, but at Joe Cooper Hyundai of Midwest City, deals change daily. Don’t risk missing today’s offers—browse specials, pre-qualify online, or call today before they’re gone.

What APR is Hyundai offering?

Hyundai’s APR offers change frequently by model and buyer qualifications. Right now at Joe Cooper Hyundai of Midwest City, you can explore the latest low-APR deals on new inventory. To see if you qualify, use our pre-qualify tool with no impact on your credit, or get personalized numbers through our finance center.

How can I lower my Hyundai car loan rate?

At Joe Cooper Hyundai of Midwest City, you can explore lower rates by getting pre-qualified online with no credit impact, trading in your current vehicle at our trade tool, or refinancing if your credit has improved. Our finance team also keeps you updated on Hyundai’s changing offers, so you never miss a chance to save.

What is the best way to finance a Hyundai?

The easiest way to finance a Hyundai is to start by getting pre-qualified online at Joe Cooper Hyundai of Midwest City—it takes just 90 seconds and won’t affect your credit. From there, our finance team can walk you through current Hyundai offers, custom loan options, and trade-in values at our trade tool. Because incentives change often, comparing your pre-qualification with Hyundai’s latest deals helps ensure you get the best fit for your budget.

Does Hyundai allow refinancing?

Hyundai itself doesn’t refinance loans, but you can explore refinancing through banks or credit unions. At Joe Cooper Hyundai of Midwest City, our finance team can still help you weigh your options and even get you started with a quick pre-qualification check that won’t affect your credit. If you’re curious about your car’s current value before refinancing, you can also get a trade estimate right on the site.

What credit score do you need for 0 APR Hyundai?

Most 0% APR Hyundai deals are reserved for buyers with excellent credit, often 740 or higher. But since offers change often, it’s best to check what’s available now. At Joe Cooper Hyundai of Midwest City, you can get pre-qualified in 90 seconds with no hit to your credit and see where you stand. From there, our finance team can walk you through options and even factor in your trade value to help make the numbers work.

What is the gap insurance on a Hyundai?

GAP (Guaranteed Asset Protection) insurance helps cover the difference between what you owe on your Hyundai and what insurance pays if it’s totaled or stolen. At Joe Cooper Hyundai of Midwest City, it’s an option you can add when financing or leasing, and it can bring peace of mind if you’re worried about depreciation. Since offers and details vary, the easiest way to see if GAP fits your plan is to get pre-qualified in minutes or chat with our finance team when you’re exploring vehicles in our new or used inventory.

Does Hyundai include gap insurance?

On most Hyundai leases, gap insurance is built in at no extra cost. For financed vehicles, it isn’t automatically included, but Joe Cooper Hyundai of Midwest City can walk you through your options when you apply for financing or get pre-qualified. Coverage details can change, so it’s always smart to ask our team directly before you buy.

Sales Hours

Sunday

Closed

Monday

8:30am - 8:00pm

Tuesday

8:30am - 8:00pm

Wednesday

8:30am - 8:00pm

Thursday

8:30am - 8:00pm

Friday

8:30am - 8:00pm

Saturday

8:30am - 7:00pm